The USA rejoined the Paris Accord in 2021 through a Presidential Order signed by US President Joe Biden. Since then, they have pledged to reduce emissions by 52% by 2030, compared to 2005-levels and to reach net-zero by 2050.

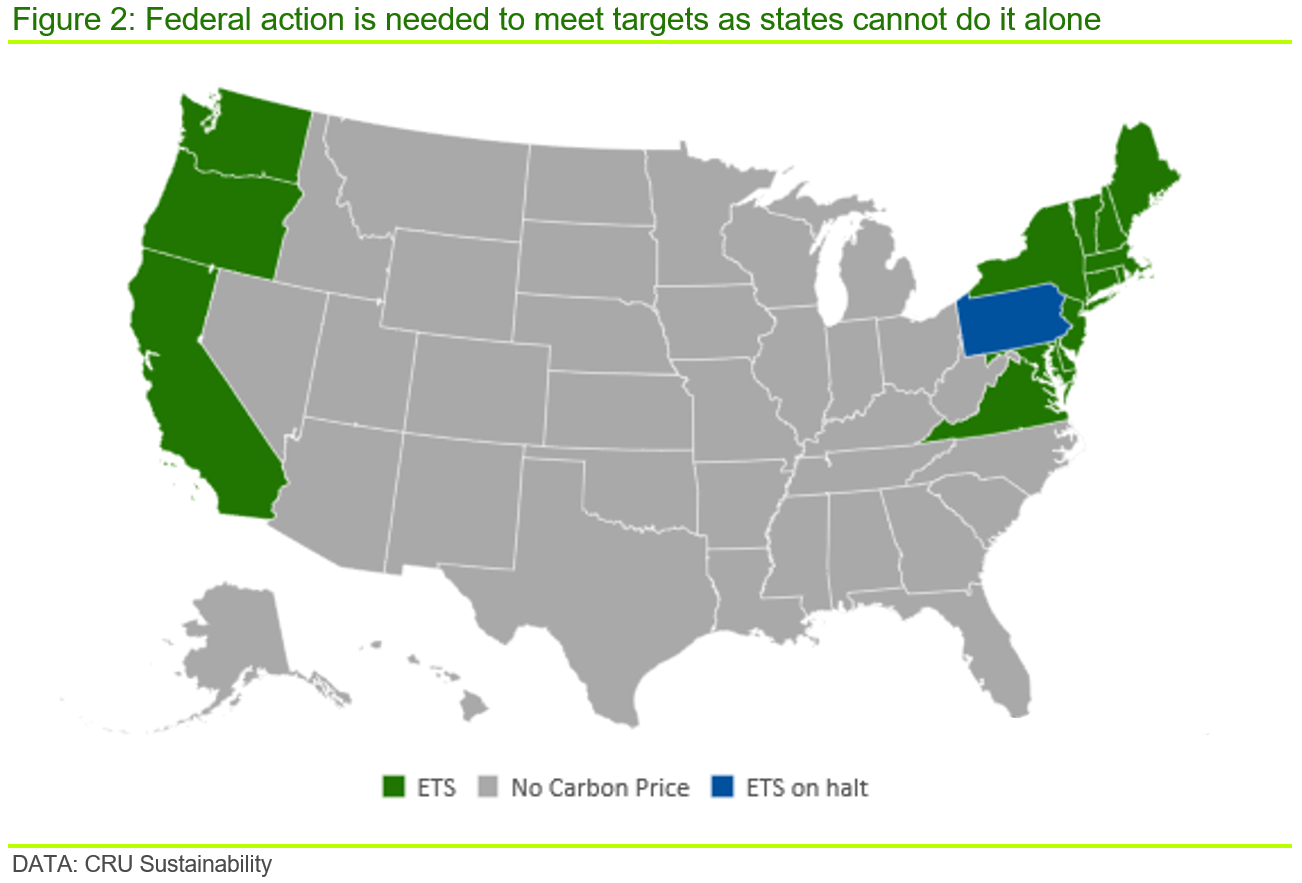

In our view, one of the most efficient ways to accelerate decarbonisation is by imposing a carbon price. This can be either in the form of a direct carbon tax on emissions or setting a limit on emissions and letting the market decide the price of allowances (i.e. cap and trade). While about a quarter of US states currently have some form of carbon pricing in place, there is currently no plan to implement a scheme at the federal level. Rather, decarbonisation is currently being incentivised via tax credits through the Inflation Reduction Act (IRA). However, our view is that the subsidy approach is not viable in the long term and that some form of carbon pricing will ultimately prevail.

Here, we use CRU’s Carbon Abatement Curve to understand what that carbon price would need to be for the USA to meet its emission reduction targets out to 2050 assuming carbon price was the primary driver of emission reductions. Further, we explain the main drivers of this price over time.

Cheap fossil fuels are a double-edged sword

While net zero by 2050 suggests a similar decarbonisation pathway to the EU, the drivers of carbon price for the USA between now and then are quite different. Firstly, decarbonisation is more front-loaded in the USA, requiring an ~42% reduction for current levels, whereas for Europe, the ‘Fit for 55’ policy implies an equivalent ~35% reduction. As such, the USA will need a relatively steep rise in the carbon price in the early years if it is to achieve its aims.

Another key driver of the carbon price is the relatively high cost of switching from traditional fossil fuel-based technologies to low-carbon technologies. The USA currently enjoys much lower gas and coal prices compared to Europe, but this simply increases the cost differential between fossil fuel-based and low-carbon technologies, thus rendering switching costs much higher. On the other hand, given fossil fuels are relatively low cost in the USA, fuel efficiency is less of a focus, which raises the cost of fossil fuel-based technologies and so reduces the differential with low-carbon alternatives. According to the US Department of Energy, the average coal-fired power plant in the USA operates close to 33% efficiency. In the EU, where coal power plants are exposed to higher fuel prices, the same metric is ~42%. The same argument is relevant for passenger vehicle fuel use.

Here, we take account of these factors – as well as expected reduction in costs of low-carbon technologies over time – within CRU’s Carbon Abatement Curve, to determine the carbon price needed to incentivise a particular technology change by year.

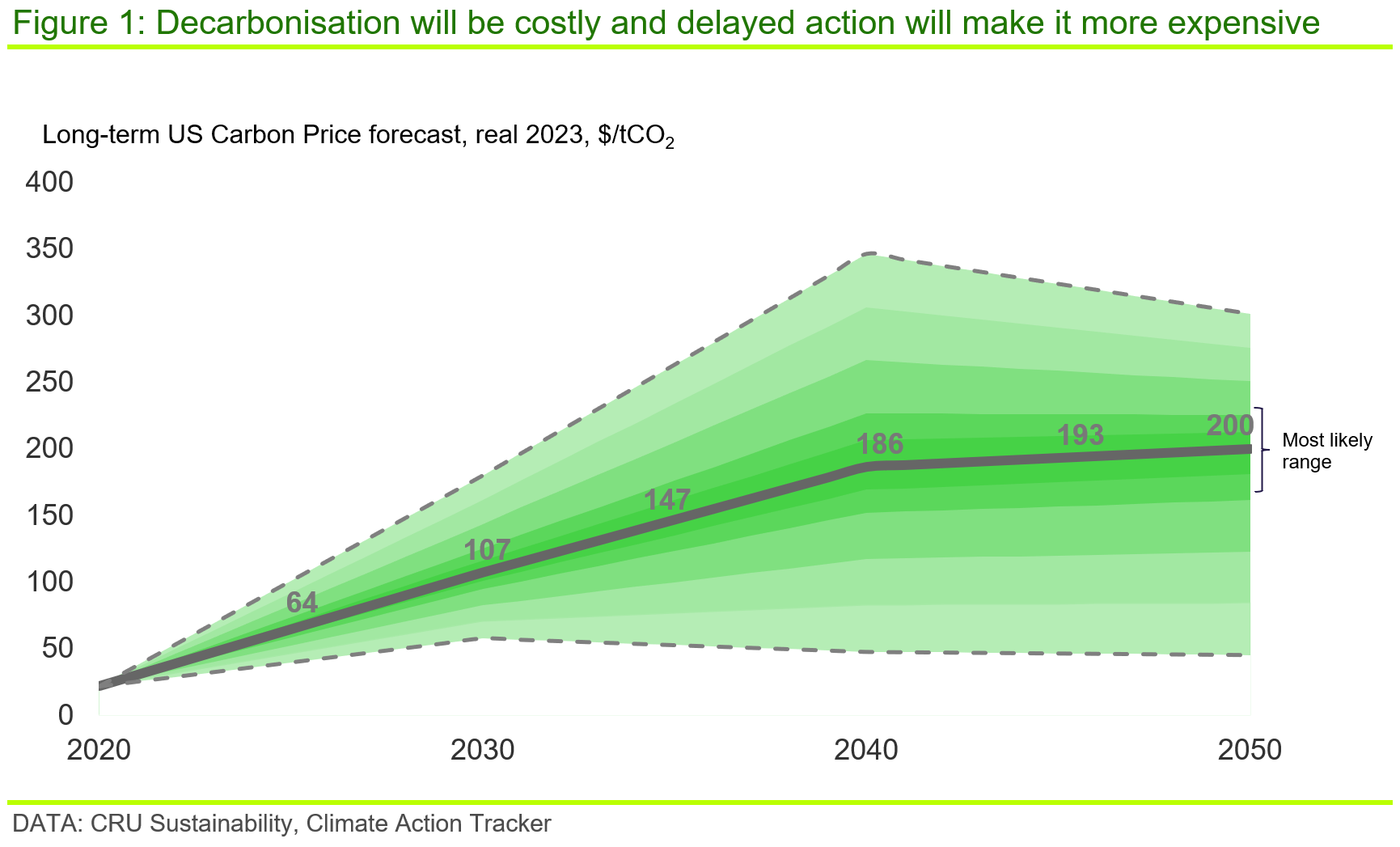

Steep rises in carbon costs are needed out to 2040 to enable new technologies

Taking into account the above factors, we estimate that the USA needs a carbon price of ~$107 /tCO2 by 2030 (real 2023) if it is to achieve its 2030 target emissions reduction of 52% from 2005 levels (n.b. a subsidy or tax credit may need to be higher because of the different way they act, certainly higher than credits under IRA). Such a price would be sufficient to encourage lower cost decarbonisation options, such as improving energy efficiency and replacing coal in the energy system.

Under its Nationally Determined Contribution (NDC) plan, a further ~30% emissions cut is needed by 2040 and the carbon price would need to rise rapidly to incentivise more expensive decarbonisation options. In the 2030s, technologies such as carbon capture and storage (CCS) and ammonia use as a fuel need to become more cost-competitive with fossil fuels and widespread to tackle hard-to-abate sectors that are responsible for a sizeable proportion of the national emissions profile (e.g. fertilizer production, cement production and haulage). Having eliminated much of the coal power by 2030, lower cost and less emitting gas power production also needs to be tackled before 2040, while some technologies will continue to rely on gas or coal. CRU estimates that carbon price would need to rise to ~$150 /tCO2 by 2035 and ~$190 /tCO2 by 2040 to keep decarbonisation targets on track.

After 2040, green hydrogen and ammonia must become sufficiently cost-competitive to tackle those hard-to-abate sectors with particular technological challenges, such as steel production or marine transportation. With most of the economy decarbonised and low carbon technology costs continuing to fall, the carbon price curve flattens somewhat in the 2040s, but keeps increasing to reach ~$200 /tCO2 by 2050, which is lower than, but comparable to, our European carbon price long term forecast.

Delayed transition can lead to higher carbon prices

In order to establish a CRU base case as well as different outcomes, our analysis explores a number of scenarios grounded on different policy and target emission reduction options and different technology cost trajectories. For example, a faster rate of low-carbon technology cost reduction will lower the carbon price needed to incentivise technology change. Equally, a more rapid, or slower even, emission reduction target (e.g. net zero by 2040 or 2060), imply higher or lower carbon prices will be needed respectively.

So, our base case assumes the current targets remain in place out to 2050, as well as a certain level of technology cost improvement, and reflects a smooth transition. However, if a more onerous emission reduction target is imposed or, say, current subsidies are not sufficient to bring down the costs of low-carbon technologies, then a significantly higher carbon price will be needed, reaching as high as ~$350 /tCO2 in the extreme, as shown above. While this scenario is unlikely, our view is that the road to net zero will not be smooth and these scenarios – and the price extremes they lead to – are an attempt to understand the implications for carbon price under less benign conditions.

Will the US implement a federal carbon pricing scheme?

Despite the fact that carbon pricing schemes exist on a state- and superstate-level in the USA, it is unlikely that a federal carbon pricing scheme will be introduced in the near future. Unlike the EU, the USA has favoured incentivising desirable behaviour, rather than penalising undesirable behaviour and, in 2022, Congress passed the landmark IRA, which allocates $369 bn to green subsidies across the energy, manufacturing and transportation sectors.

Whilst this sounds like a significant amount of money directed towards decarbonisation – that will have an impact – our analysis finds that an effective carbon price ~$105 /tCO2 is required by end-decade if the USA is to rapidly incentivise reduced emissions. However, our very preliminary analysis suggests that subsidies under the IRA do not match this (i.e. they are not enough to incentivise the change required). Further, the carbon price would need to rise close to ~$200 /tCO2 by 2050 to accomplish targeted emission reductions under our base case. We question whether the implied increased level of ongoing subsidy out to 2050 is a viable option.

While subsidies can support the transition and help to kick-start nascent markets in low-carbon technology and drive down costs, given the USA is currently grappling with the debt ceiling, we believe it will be difficult to pass large spending bills through the Congress in the upcoming years. In addition, tensions have risen between the EU and the USA over the green subsidies included in the IRA, as they create an uneven playing field for investments between the North Atlantic allies and this could raise further challenges, explore the first insights of our three-part insight series on the race to dominate future markets here. Thus, whilst the USA had to act to stay in the race for net zero with the other major economies, we believe further policy will be required if it is to achieve its stated emission reductions. Ultimately, this is more likely to involve a carbon price than subsidy.

It is our intention to follow up this insight with a second looking at how subsidies under the IRA impact on the required carbon price needed to incentivise the targeted emissions reductions. If you are interested in talking about our approach to carbon pricing, or if you need a rigorous, defendable carbon price for your planning or projects, please get in touch with us and we would be happy to talk.

Find out more about our Sustainability Services.

Our reputation as an independent and impartial authority means you can rely on our data and insights to answer your big sustainability questions.

Tell me more