Part one in this three-part Insight series sets out green policy options in general

China, the USA and Europe are pursuing different strategies to establish their leads in future green markets. In mid-2022, the US government launched the Inflation Reduction Act (IRA). EU policymakers are concerned that the financial support offered by the IRA to US-based green businesses could make Europe relatively less attractive as a green-tech location, adding to pressure from Chinese competitors. With a Green Deal Industrial Plan, EU policymakers now want to level the playing field by promising faster permitting, better funding, skilled workers and resilient supply chains. While EU policymakers agree that something needs to be done, how to fund it will be controversial. EU subsidies to green businesses would be costly to European governments but could also lead to new green innovations and capacity building in green technology and production beyond what could be achieved by the IRA alone.

Part two in this series will cover the EU Green Industrial Plan and Net Zero Industry Act. In part three we assess whether the latest policy developments can accelerate the green transition and what consequences they might have for commodity markets.

A three-way race between China, the USA and Europe to dominate future green markets

Climate change and the required green transition are as much an opportunity as a challenge, with an increasing number of green businesses hoping to develop world-beating products and services that they can sell across the globe and governments aiming to make their countries world leaders in the markets of the future.

China, the USA and Europe are all vying to establish themselves as the centre of global innovation in green technologies. The potential reward could be huge in the form of new jobs, rising prosperity and reduced dependency on other countries for crucial products and services for the transition. Secure supply chains, in particular for critical minerals, have become an increasingly important policy consideration at a time of heightened geopolitical tensions.

How can countries take the lead in green-tech?

How to foster innovation to support economic growth and achieve desirable outcomes?

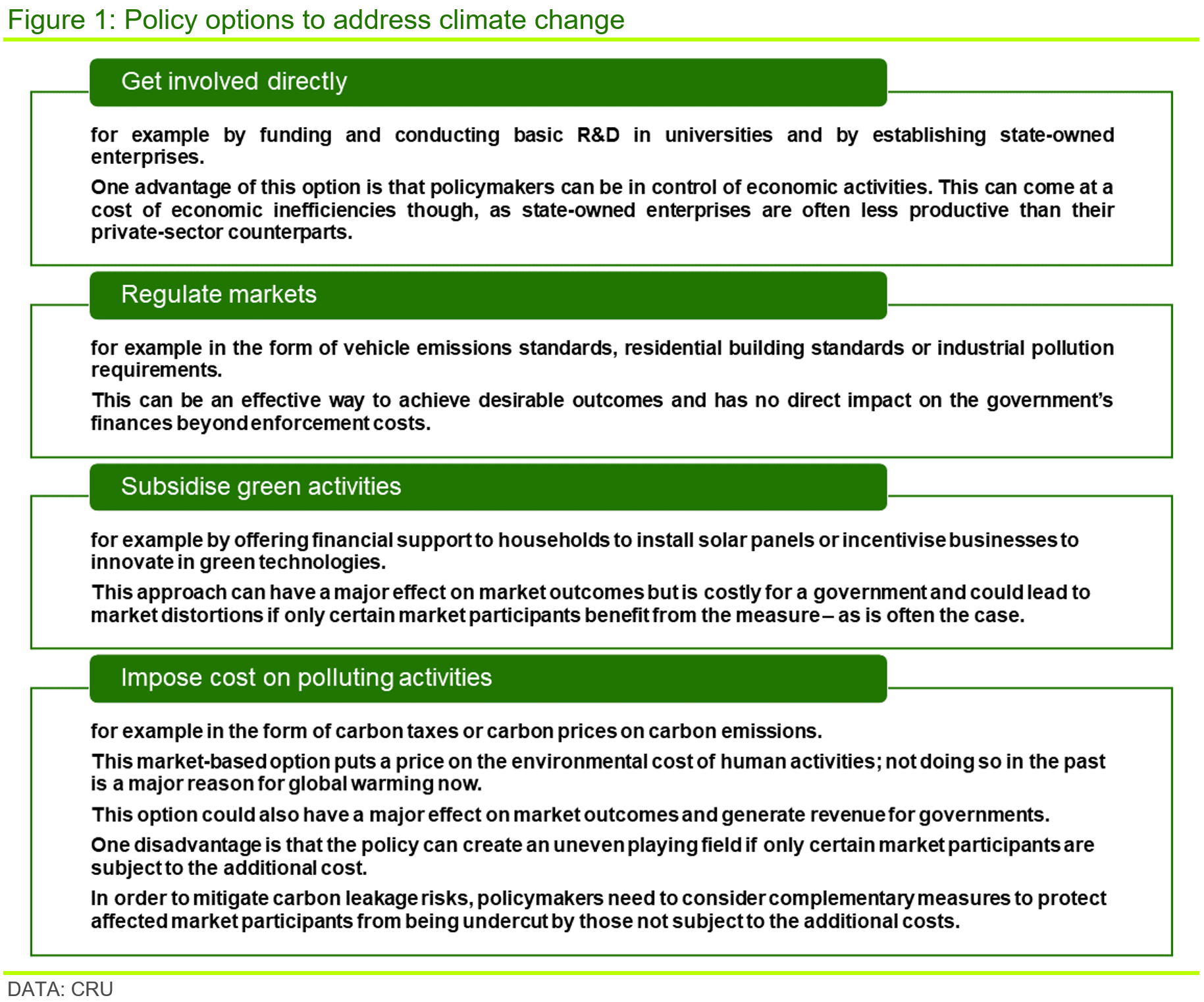

This is a fundamental question for policymakers to answer and is increasingly starting to dominate global efforts to mitigate climate change. The main policy options to address climate change are summarised in Figure 1.

While do nothing is an option in principle it is not in practice as it fails to address the global market failure that has led to global warming in the first place.

Similar objectives, different approaches

While China, the USA and the EU have all pursued similar objectives, such as improving environmental standards and supporting domestic businesses to succeed in a rapidly emerging global market, they have historically done so in different ways.

The biggest difference has been the role of carbon pricing in driving environmental change. While carbon pricing does not play a role on the federal level in the USA (n.b. it does though on the state level) and China only launched a national emissions trading scheme (ETS) in 2021 with a relatively low carbon price, the EU has put great emphasis on this policy. The EU ETS was established in 2005 and is the largest and most developed emissions trading scheme globally. The EU ETS carbon price is also one of the highest globally. By contrast, subsidies have not played an important role in the EU as state aid is generally prohibited.

Levelling the playing field: Foreign Subsidies Regulation and CBAM

The approaches are not necessarily compatible and have required complementary policies to protect domestic interests. While officially motivated by domestic climate change considerations, foreign policymakers have frequently criticised them for being protectionist in nature.

The EU, for example, launched its foreign subsidies regulation in January 2023 to address anti-competitive and market-distorting policy interventions in the form of subsidies in third countries in general and China in particular. According to the European Commission (EC), this new regulation addresses a regulatory anomaly, namely that subsidies granted by EU member states are subject to close scrutiny – and are generally prohibited under the EU’s state-aid rules – while subsidies granted by non-EU governments to non-EU businesses operating in the EU’s Single Market go unchecked.

According to the EC, this has not only advantaged non-EU businesses in the product markets but also given them an unfair advantage when acquiring companies or obtaining public procurement contracts in the EU. Under the new regulation, the EC can impose measures on non-EU businesses to correct this. This regulation is not explicitly about climate change but it is likely that green-tech will make up a notable share of future cases.

In mid-December 2022, EU policymakers also provisionally agreed on a Carbon Border Adjustment Mechanism (CBAM) to shield EU-based producers faced with carbon prices from foreign producers operating in countries without, or with less ambitious, explicit carbon pricing schemes. CBAM in its current form has been set up to minimise carbon leakage by stopping EU-based businesses losing market share to producers in locations with higher GHG emissions. CBAM currently does not provide subsidies to EU-based exporters to other regions and as such does not protect EU-businesses from losing market share in foreign markets.

Some US policymakers have argued that environmental regulation also imposes significant costs on their own businesses and that not taking account of them when setting CBAM rules is unfair. Establishing regulatory equivalence with the EU ETS carbon price is difficult though as no accepted methodology exists with which to convert the mixture of incentives, standards, and federal investments that apply to US production into a US carbon price for products. Moreover, the argument ignores the fact that European businesses also face significant environmental regulation and misses the point that the EU ETS directly addresses one of the main causes of climate change by creating a previously missing market – and market price – for carbon emissions. Given that climate change is a global phenomenon, global carbon pricing is generally seen as one of the most efficient and effective ways of supporting the energy transition. The International Monetary Fund, for example, has argued for an international carbon price floor, depending on a country’s level of economic development.

The US Inflation Reduction Act raises the game

The US Inflation Reduction Act, launched in mid-2022, opens a new chapter in the race to dominate future green-tech markets. The sheer size of the financial incentives offered to US businesses and consumers as part of the IRA – many of them with conditions attached aimed at supporting the domestic economy – has the potential to shape global green-tech markets in the future.

EU policymakers are concerned that the incentives offered as part of the IRA could make Europe a less attractive location for green-tech businesses and ultimately jeopardise its ability to support the industries required for the energy transition. Over recent months EU policymakers have worked on a European response in the form of the EU Green Deal Industrial Plan that would level the playing field with the USA.

Part two of this mini-series provides more detail on the EU Green Deal Industrial Plan, including the supporting Net-Zero Industry Act and Critical Minerals Act.

In Part three of this mini-series we will assess whether the latest global initiatives can accelerate the energy transition and what consequences they might have for the commodity markets.

To discuss any of the issues covered in this or any of our previous Insights please reach out to CRU Sustainability.

Find out more about our Sustainability Services.

Our reputation as an independent and impartial authority means you can rely on our data and insights to answer your big sustainability questions.

Tell me more