Commodity supply, demand and prices are routinely affected by both seasonal and extreme weather events. As climate change gathers pace, the severity of seasonal weather and the occurrence of extreme weather events is increasing. The understanding of weather is therefore crucial to prepare and navigate consequent market and price volatility.

Is weather a growing concern?

Regional weather has a large and often unavoidable impact on the physical commodity market. Supply can be impacted directly – through flooding at mine sites or crop failure in dry conditions; and indirectly – through damage to infrastructure required to deliver products to consumers. Inventories are also susceptible as physical stocks can spoil if improperly stored. This may amplify inventory shortages as inventories are typically run-down to mitigate supply gaps caused by extreme weather. End-use demand can also change as weather impacts production of physical goods. As such, extreme weather events can result in sudden changes in commodity prices resulting from the shifting supply balance, demand and inventories.

While seasonal weather fluctuations have always required consideration, climate change has increased the frequency of irregular weather patterns including warmer summers and wetter wet seasons – ‘once in a generation’ extreme weather events seem to happen with increased frequency. Disruption due to such weather events will increasingly test commodity markets, thereby increasing risk of supply shock and price volatility.

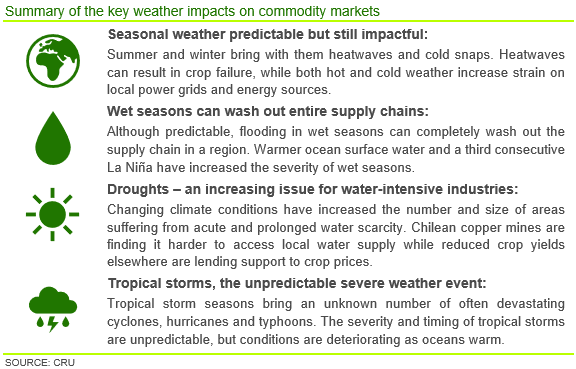

Seasonal weather predictable but still impactful

Understanding the timing of significant weather events, and commodity supply in the affected area, can increase disruption preparation in markets. Weather events, especially extreme weather events, are constrained to seasons when the correct atmospheric conditions are present. The seasonality of weather introduces a level of weather risk for different regions during different periods of the year.

Summer and winter in the northern and southern hemispheres bring heatwaves and cold snaps. In the tropics, seasonally warmer ocean water instigates wet seasons and tropical storms. Weather risk is, however, becoming harder to accurately define as global warming alters atmospheric conditions which can increase the occurrence and severity of weather events.

Heatwaves – a short-term pressure to power grids

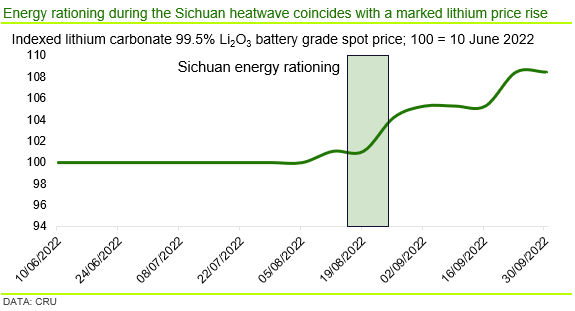

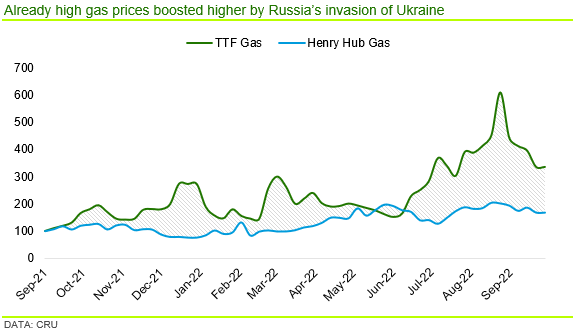

Heatwaves can create a significant but short-term supply shock. High heat increases strain on local power grids as more energy is diverted to cooling buildings. Energy intensive industries tend to suffer in these conditions as the cost of energy rises or energy is rationed to ensure power availability to citizens. The impact is increased when energy is already scarce and prices are high – as they are now across Europe and other regions following Russia’s invasion of Ukraine.

In the summer of 2022, China and Europe experienced intense and prolonged summer heatwaves. The temperature of the Rhine rose while water levels dropped, reducing France’s nuclear power output and river freight traffic. Meanwhile, falling Chinese reservoir levels resulted in the disruption of operations capable of 1 Mt/y of primary aluminium capacity, 1.8 Mt/y aluminium semis capacity and the loss of 5–6 kt of LCE production. Production at these facilities was halted for ten days, from 15–25 August which coincides with a marked increase in the spot Chinese lithium carbonate price.

Summer dryness and autumn wetness weigh on crop yields

Much like energy, crop yields have also been under pressure from excessive heat. While droughts and floods impact crop production every year, 2022 has been notably worse than recent years.

Significant portions of the US, Europe, SE China and East Africa were in drought conditions this summer. This has negatively affected crops yields across the board. The knock-on effect is most prominent in East Africa which is facing famine due to the extreme conditions. A relatively high proportion of the population in the region are farmers, so extreme weather can have dramatic consequences. The region’s weak purchasing power relative to the rest of the world exacerbates its fragile food security as countries around the world need more food imports but face potentially fewer supplies.

Wetness and flooding in Sub-Saharan Africa, NE China and Pakistan hampered crop production. Australia and Brazil are the exception where autumn wetness is set to boost agricultural output in the 2022/23 season. This is due to the onset of the third consecutive La Niña weather system. Overall, these events act to support crop prices in the short-term and in turn support fertiliser demand.

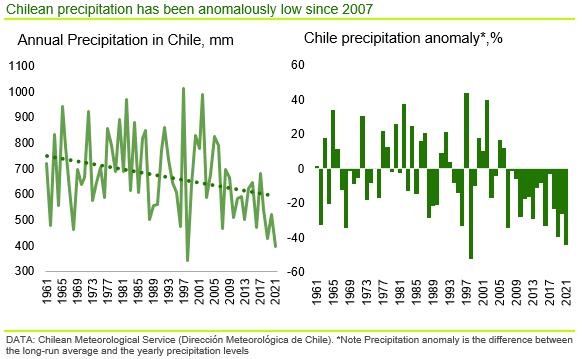

Chile’s water availability an increasing issue for miners

While water levels and rainfall fluctuate, the changing climate has increased the number of regions afflicted by acute and prolonged water scarcity.

Water scarcity in Chile is the highest profile case of acute water shortage in the mining industry. Chile has experienced significantly reduced rainfall for the last 15 years, with a noticeable worsening in the last three La Niña years.

Water scarcity has been one of the several factors that have resulted in Chile’s copper output dropping in recent years. Antofogasta directly blamed reduced rainfall, alongside falling ore grades, for a reduction in production guidance in 2022 Q2 (subscribers to copper services, see CRU View ‘Guidance lowered again as miners continue to face challenges’). Codelco has re-committed investment to a $1 billion desalination plant as it aims to reduce water consumption in the arid copper mining regions (subscribers to copper services, see CRU View ‘Codelco revives desalination plan’).

Wet seasons can impact the entire value chain

Due to the seasonality of wet seasons, their impact on commodity markets can usually be reduced. However, as the global climate changes, wet seasons are becoming more intense, increasing their impact and overriding the mitigating effects of preparation.

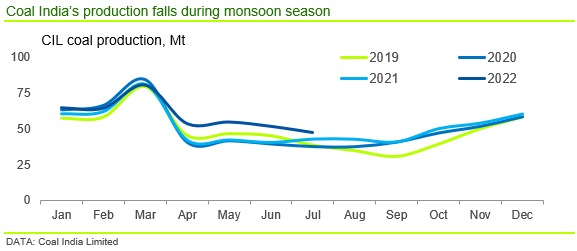

Regular wet seasons disrupt the supply of raw materials as both mine site activity and road transport slow down, creating a supply shortage for end-users. As such, significant inventory stocking is often seen before the arrival of a wet season. Production can often spike to accommodate this pre-wet season demand. For example, India’s thermal coal production increases in February and March as power plants buy in coal to guarantee power supply over the Monsoon season. The pre-wet season demand spike is often followed by a demand and production lull as end-users work through inventories and supply becomes disrupted by the wet weather.

Recent wet seasons have, however, increased in intensity. Flooding in Pakistan in 2022 has devastated large swathes of the country and was caused by a combination of heavy monsoon rains and increased glacial melt due to intense heatwaves. Wet seasons of this magnitude cannot be mitigated by pre-season inventory stocking. They cause long term damage to supply, transport and demand infrastructure that will impact the market balance for much longer than the usual few months impacted by regular wet seasons.

Tropical storms – a major disrupter

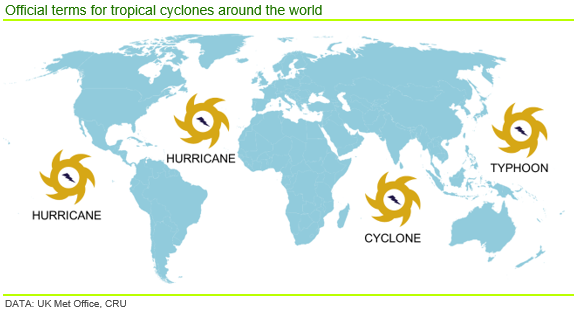

Tropical storms are generated over the world’s oceans in the tropics, characterised by a low-pressure centre surrounded by strong, spiralling winds. While tropical storms in different areas often exhibit similar characteristics, they are named differently. The Northwest Pacific typhoon basin is the most active, the North Indian cyclone basin is the least active and Atlantic hurricanes – especially those that make landfall in the US – tend to generate the most damage.

Tropical storms are individual storms that can occur independently from or overlap with wet seasons. While these storms tend to occur during specific seasons, they are much less predictable. A storm’s intensity, timing and exact path can all vary significantly, giving market participants very little time to prepare.

If a tropical storm is large enough, it can devastate an entire value chain in a certain area. High winds and heavy rain can destroy mine site facilities, warehouses, critical supply chain infrastructure and end-user manufacturing facilities such as steel mills or aluminium smelters. As they can appear suddenly, market shocks can be hard to avoid if storms hit areas that are key to a certain commodity market.

Three consecutive years of La Niña wash out Australia

Australia has experienced higher than usual rainfall in 2022, which can be attributed mostly to the impact of the La Niña weather system on Australia’s wet season exacerbated by climate change.

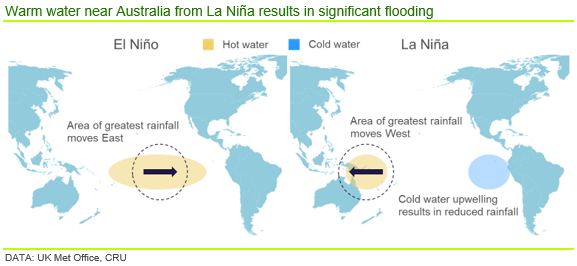

El Niño and La Niña are weather patterns caused by the temperature distribution surface water in the Pacific. The position of warm surface water in the Pacific correlates with the highest levels of precipitation. During El Niño years, weak trade winds allow hot surface water to spread eastwards, reducing rainfall in the western Pacific and increasing the chance of droughts in that region. La Niña years are the opposite, with strong trade winds concentrating hot water in the west Pacific, increasing the chance of flooding in the region, while upwelling cold water in the eastern Pacific increases the chance of droughts.

The La Niña weather system resulted in exceptionally high rainfall in Eastern Australia’s October–May 2022 wet season. Queensland accounts for ~80% of Australia’s metallurgical coal exports and the rain caused Australian met coal exports to drop 8% compared to historic averages in May. Iron ore exports were similarly impacted by La Niña-boosted wet seasons in both Australia and Brazil. This situation will not improve soon as Australia has just declared a rare third consecutive La Niña year.

Weather a factor now and an increasing one going forward

Weather can greatly impact delicate commodity market supply and demand balances as well as prices. The risk of weather events can only be factored in if accounted for, making the understanding of weather a key tool for understanding market volatility.

Hurricane Ian is an example of how rapidly extreme weather can appear and impact commodity markets. The closure of Mosaic’s phosphate rock and fertiliser operations reversed the price decline of North America DAP, with the impact on supply currently uncertain.

The oncoming winter and gas shortage in Europe is an example of a predictable, but hard to manage seasonal weather impact. As temperatures cool in the autumn and winter months, demand for heating and electricity will seasonally increase. This is of particular concern for countries dependant on the now curtailed Russian gas supplies, such as Germany and the majority of Eastern Europe, as well as other gas importing countries where gas prices have risen to high levels.

High gas prices have already resulted in significant production curtailments in the European nitrogen fertiliser industry. A combination of high energy prices and low gas supply could be devastating for other metal producers, particularly the energy intensive aluminium.

Commodity markets are well versed on the effects of seasonal weather and can mitigate the impacts through actions such as the pre-wet season production boosts and increased inventories – as seen in India. However, increasingly erratic seasonal climate patterns and extreme weather events increase the impetus on markets to be forward-thinking in order to absorb price volatility and higher prices resulting from the increasing frequency of impactful weather events. Therefore the implementation of mitigation strategies is paramount. While mitigation of some weather events is impossible, increased preparation will always reduce the impact on markets to a degree.

Find out more about our Sustainability Services.

Our reputation as an independent and impartial authority means you can rely on our data and insights to answer your big sustainability questions.

Tell me more