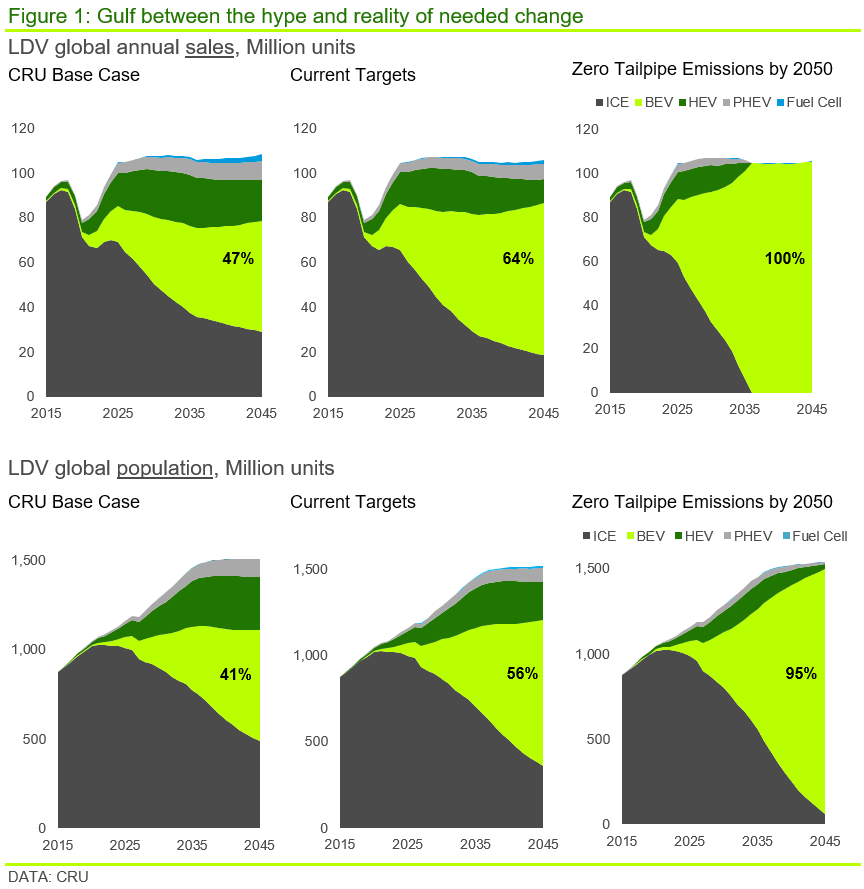

Electric vehicle markets are changing fast and there is a huge degree of uncertainty about the path they may take. Many argue we are now at a crossroads, where penetration rates will increase exponentially, and the internal combustion engine will soon become a thing of the past. CRU’s Base Case, while positive, is more measured than this.

This insight demonstrates the gulf between the hype and the sheer amount of structural change needed in these markets by reflecting on three scenarios:

- Base Case – This is our base case forecast for the powertrain mix in light duty vehicle (LDV) markets. We quantify the gap between this and what would be required in the two scenarios below.

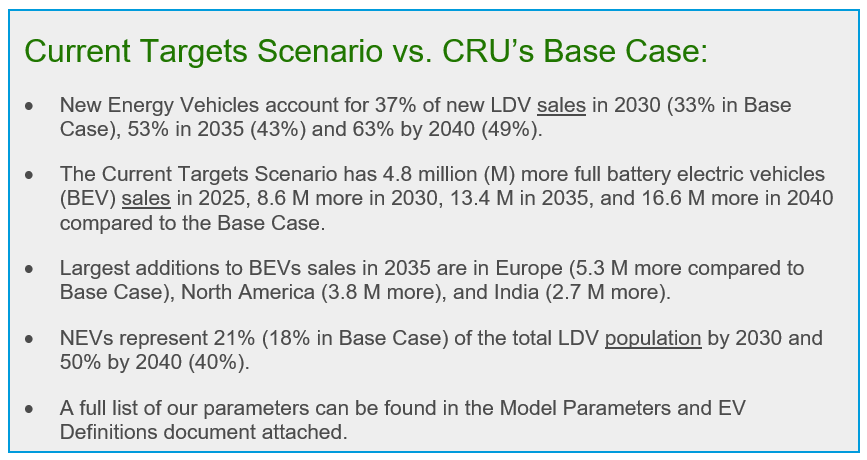

- Current Targets Scenario - What would EV penetration rates look like if all current global government targets were hit?

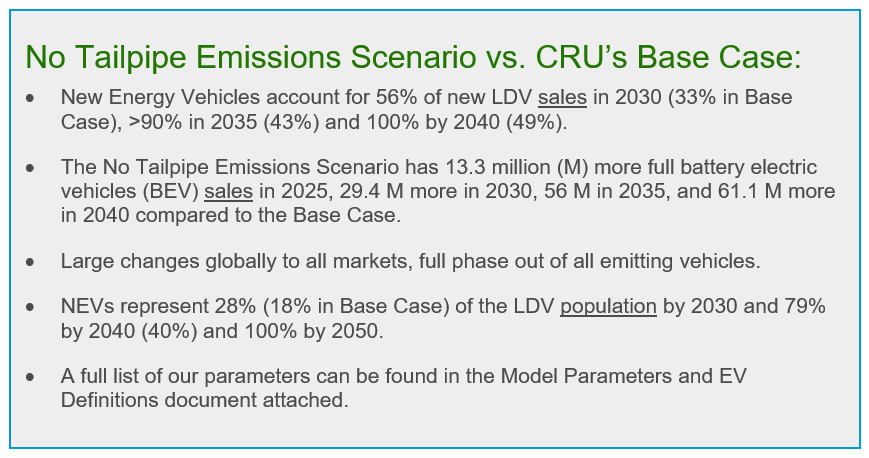

- No Tailpipe Emissions Scenario – This scenario examines the numbers behind the debates surrounding net zero targets. Here we ask what the light vehicle market would look would like if only vehicles with no tailpipe emissions (direct automotive emissions from combustion of gasoline and diesel) were on the road in 2050?

CRU’s Key Takeaways:

- There is a considerable gap between our Base Case and current government targets.

- Most current targets covering the light vehicle sector are non-binding and pathways to hitting them are unclear.

- The scale and timeline of government policies, including subsidies, will remain one of the most significant factors in determining EV penetration rates.

- There is a huge amount of upside to our Base Case if governments and original equipment manufacturers (OEMs) commit to binding targets, increase infrastructure spending, and if new energy vehicle (NEV) unit costs continue to fall.

- For there to be no tailpipe emissions by 2050, there is only a limited time to take all combustion engines off the road, due to vehicle life expectancies.

- Governments or consumers could be left with a sizable bill if mass scrappage schemes are required in the 2030s and 2040s to change powertrain mixes in the vehicle population. This would have wider implications for secondary metal markets globally.

Rollout of electric vehicles will not be easy or cheap

In our Base Case, the mid to late 2020s represent the “inflection point” for BEV sales, after which we expect them to gain widespread adoption and significantly eat into internal combustion engine (ICE) market share.

We forecast a rapid increase in NEV penetration rates from a low base; under 10% of sales in 2021. By 2025, automotive OEMs should have the resources, experience, and capacity to begin widespread EV production. This will help drive NEV penetration rates higher, rising to 30% of LDV sales by 2030.

However, our Base Case assumes that most targets globally are missed, and even by the mid-2040s close to half of all new global LDV sales are powered by either internal combustion engines (ICE) or are hybrid vehicles (HEV).

Electric vehicles will lead to the single biggest transformative effect on global mobility in the coming decades. Our Base Case assumes China and Europe will see rapid NEV penetration rates, more modest growth in North America and slower adoption rates elsewhere.

The Current Targets Scenario assumes all current government targets globally, when focused on the automotive market, are hit. These are either binding or non-binding and include some extremely loose commitments and rather vague promises. However, this scenario does not factor in net zero aims or aspirations.

Vehicle populations and path dependence are central to this debate

Full battery vehicles (BEVs), with no tailpipe emissions, have seen spectacular growth recently, but they are still only about 10% of current global LDV sales. More importantly, they represent only about 2% of the global vehicle population. Populations as well as sales must be considered in any analysis.

To hit the No Tailpipe Emissions Scenario by 2050, then all new LDV sales from 2035 will need to be full battery electric vehicle or fuel cell vehicles, assuming a blanket fifteen year life expectancy for LDVs. Path dependence is a key issue when modelling technology adoption rates. With a rough 15-year life expectancy, ICE, HEVs or PHEVs sold in the late 2030s or 2040s would still be emitting by 2050.

True system change is going to be expensive

2035 is only 13 years away and seeing such huge change in such a short span will require a combination of large investments, subsidies, more ICE bans, scrappage schemes and infrastructure rollout. There will also need to be a significant shift in consumer attitudes and behaviour.

CRU attaches an extremely low likelihood to either the Current Targets Scenario or the No Tailpipe Emissions Scenario being met. However, they are useful in demonstrating the potential upside risks to the Base Case forecast and, at the same time, showing the gulf between the rhetoric and non-binding targets, and the current direction of travel.

To discuss this insight or battery materials further please contact: charlie.durant@crugoup.com, harry.fisher@crugroup.com or arthur.wang@crugroup.com

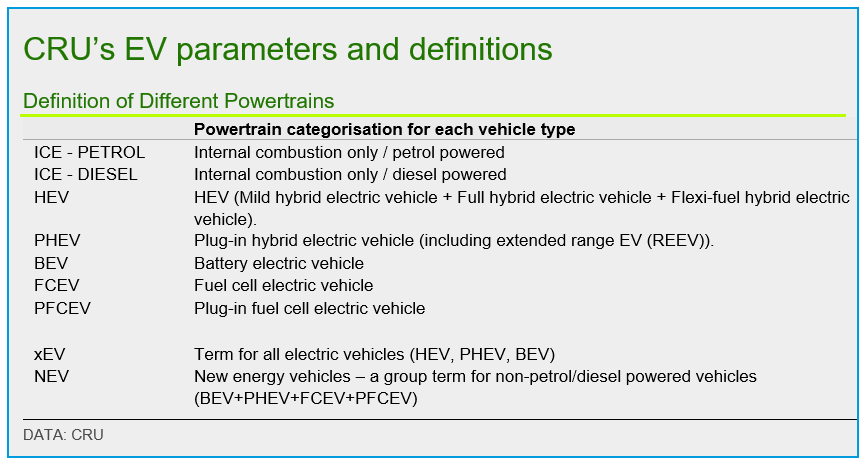

View Model parameters and EV definitions

Find out more about our Sustainability Services.

Our reputation as an independent and impartial authority means you can rely on our data and insights to answer your big sustainability questions.

Tell me more