Renewables provide the cheapest option to decarbonise large parts of the economy, but they will not provide both abundant and cheap energy – thus the world will need to accept high energy prices to decarbonise. This will have implications on the structure of the economy.

Most commentators will agree a global carbon price would be the most effective means to incentivise concerted action on decarbonisation, but there are political challenges to achieve this. However, high energy prices today provide the equivalent of an ‘effective’ global carbon price of ~$70–90 /tCO2 and so forewarn the conditions needed to encourage global decarbonisation.

In this Insight we explore the impact of high energy prices on decarbonisation in the short term and, subsequently, the implications of decarbonisation for energy prices in the long term.

Decarbonisation is the rational route to EU energy security

There has been much debate about whether current high energy prices – and concurrent energy security concerns – will knock EU decarbonisation ambitions off course, with the expectation that the bloc would fall back on coal power to alleviate both high prices and fraught gas supply. At CRU, we never felt this would be the case and developments in Europe to date bear this out.

The below sets out our thoughts on the role of energy prices in driving the transition to low carbon, both in the short term – under current energy prices – and in the long term.

Higher energy prices are a prerequisite of decarbonisation

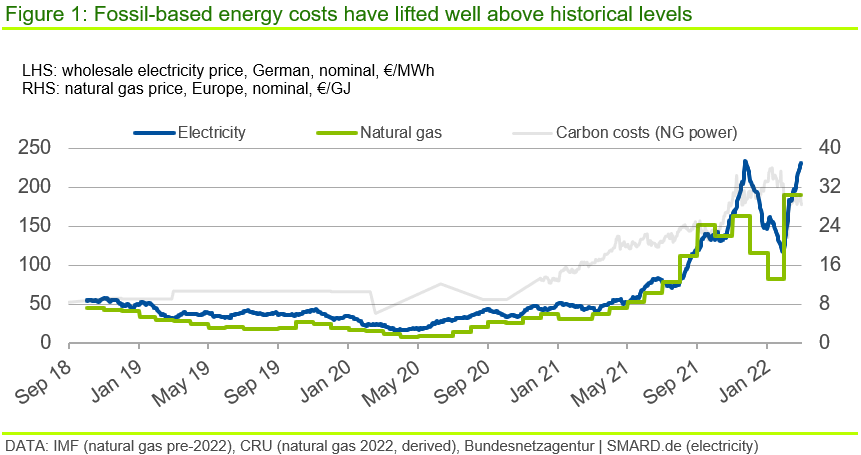

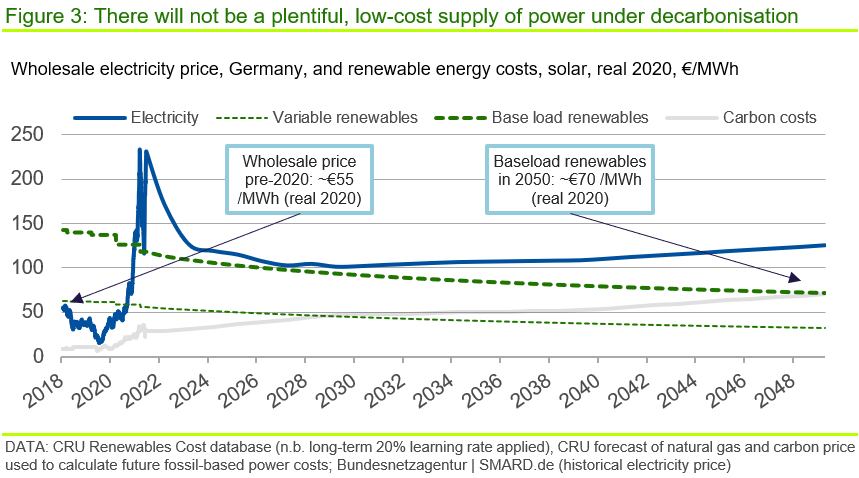

The chart below, focused on Europe, shows natural gas prices lifted from a long-term steady-state level €5–6 /GJ to ~€26 /GJ in late-2021 and, more recently, to as high as €30 /GJ, equivalent to a 5-fold increase. The chart also shows that there is a close correlation between natural gas and electricity wholesale prices, showing natural gas power provides the market-clearing generating option on most occasions.

As a result, wholesale electricity prices have lifted from a longer-term, steady-state level of ~€50 /MWh to well above €200 /MWh (n.b. higher carbon prices have also contributed somewhat to this increase, as shown by the grey line). This spike in electricity prices has prompted some to suggest the EU commitment to decarbonisation will be weakened and signal a shift back to coal.

We do not believe this is the case and, in fact, expect the opposite. That is, higher energy prices should now accelerate the decarbonisation transition or, at the very least, strengthen the commitment to decarbonise, as explained below – and any shift back to coal will be both minor and transitory.

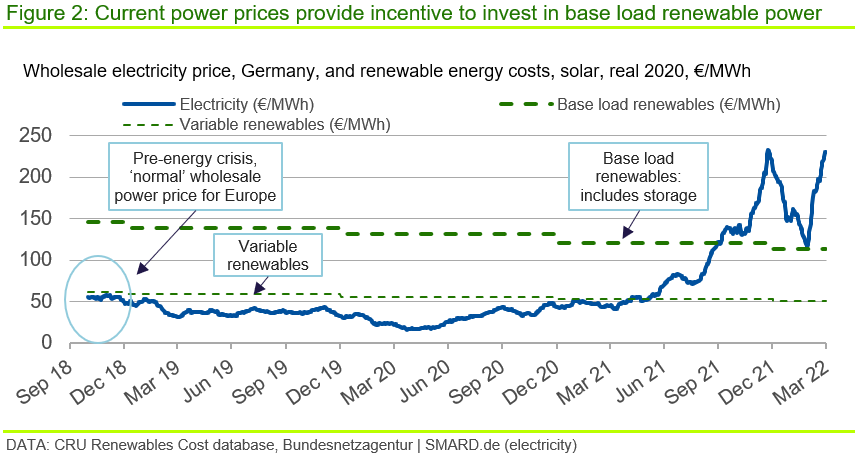

Figure 2 shows the same fossil-based power costs as above but overlays this with CRU estimates of renewable energy costs, both variable and baseload renewables. Baseload costs include necessary supply stabilisation through grid balancing. This analysis shows that in 2018 wholesale electricity prices and variable renewable costs were comparable, at ~€50 /MWh (i.e. close to the long-term, steady-state level) and ~€60 /MWh respectively. However, when necessary, grid balancing costs are factored in – and here we have used battery storage costs as a proxy – then baseload renewable costs rise to ~€150 /MWh.

In today’s situation, those added costs relate less to battery storage costs and are more often associated with payments made to fossil-based power plants to operate flexibly, turning down output when renewables output is high and vice versa. This requirement to operate flexibly at short notice has a real cost that is normally passed on in network charges rather than through the wholesale price. However, to properly model a decarbonised future, we believe these costs need to be internalised in renewable costs to give a true picture.

Looking at the right side of Figure 2, from September 2021, we see electricity wholesale prices lifted above baseload renewable costs such that, today, baseload renewables are by far the cheaper option, which should provide incentive for accelerated investment.

Renewables will not provide ‘cheap and plentiful’ power

Our forecast of natural gas and carbon prices in Europe suggest that natural gas-based electricity costs will remain above baseload renewables costs in the long term. This is a complete turnabout but it is not because renewable costs are suddenly cheaper; rather because fossil-based energy costs are suddenly more expensive – particularly when you factor in a carbon price implied by the EU’s decarbonisation ambitions.

This longer-term forecast suggests that there is now a much stronger economic incentive – as well as an energy security incentive – to accelerate renewables investment that will likely only be held back by uncertainty about the energy price forecast (i.e. will energy prices stay as high as forecast?), policy blockages (i.e. planning regulations) and available supply chain capacity to build out renewables infrastructure at an accelerated pace.

Importantly, however, you can see from the chart above that, even though we have built in an aggressive cost reduction trajectory for renewables out to 2050 – based on a 20% learning rate (i.e. costs fall by 20% with each doubling of capacity) – this only brings baseload renewable costs to ~€70 /MWh, which is above the pre-energy crisis steady-state wholesale price level of ~€50 /MWh.

That is, renewables provide an obvious route for the decarbonisation of a large part of our economy, but they are not going to lead to a ‘cheap and abundant’ supply of power compared to steady-state energy prices. This has implications for commodity production costs since decarbonisation of the sector will largely rely on renewable power directly (e.g. electrification) or indirectly (e.g. with green hydrogen). Even if we build in a continuation of the recent historical learning rate for solar energy of ~30%, this only brings baseload renewable costs down to ~€45 /MWh that, at best, translates into a hydrogen cost of ~€3 /kg, equivalent to a cost of ~€21 /GJ – or about where the natural gas price is today.

High energy price or carbon charge – two sides of the same coin

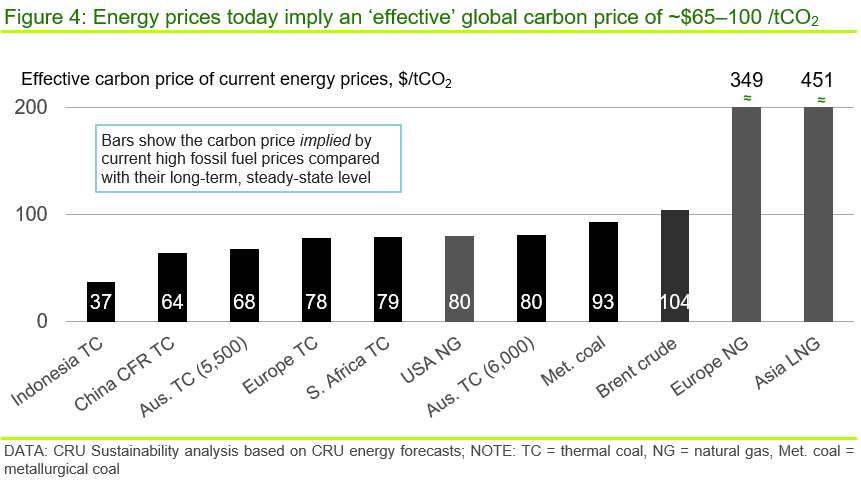

The role of a carbon price, as that in Europe, is simply to lift the cost of fossil-based energy such that – more expensive – non-fossil alternatives become economically viable. That is all it is intended to do. In that respect, a carbon price has the same effect as high fossil fuel prices, as demonstrated in Figure 4.

This chart shows a selection of fossil fuel energy sources globally and compares the current – high – spot prices with equivalent historical steady-state levels. The bars show the ‘effective’ carbon price that would need to be applied to each energy source to lift its price from the historical steady-state level to the current spot price.

This is important because the one thing most commentators can agree is that a global carbon price would be the most effective tool for promoting concerted action on decarbonisation. And, as the chart shows, today’s energy prices provide the equivalent of an effective carbon price of between $65–100 /tCO2.

That is, the position we are in today with regard to high energy prices generally (n.b. excluding the very high natural gas prices), is the exact position we need to be in at the global level – whether through high fossil fuel prices or the introduction of a carbon charge – to incentivise decarbonisation. This can also be seen in CRU’s Carbon Abatement Curve below.

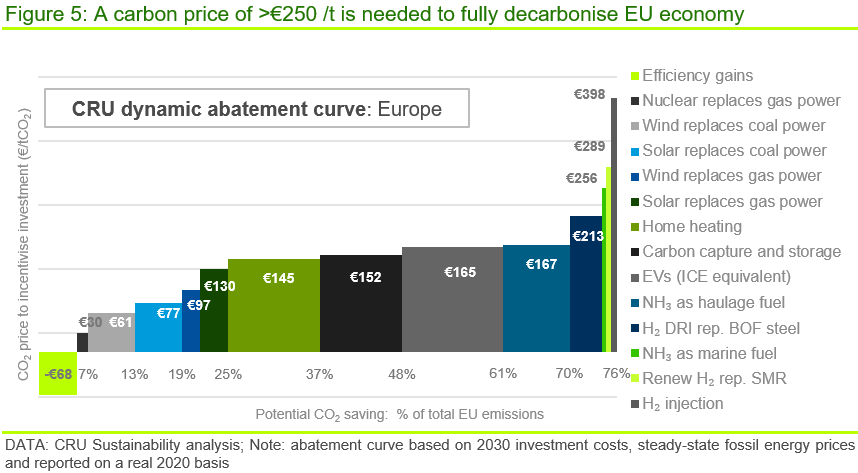

The abatement curve shows the carbon price (y-axis) needed to incentivise specific low-carbon technology shifts (e.g. solar replacing coal power or air source heat pumps replacing gas boilers) in the European economy and is based on, amongst other factors, steady-state energy prices. This shows that, across the whole economy, a carbon charge is needed to lift the cost of fossil fuel-based technologies and render low carbon options economically viable, thus demonstrating higher energy costs are a prerequisite of decarbonisation.

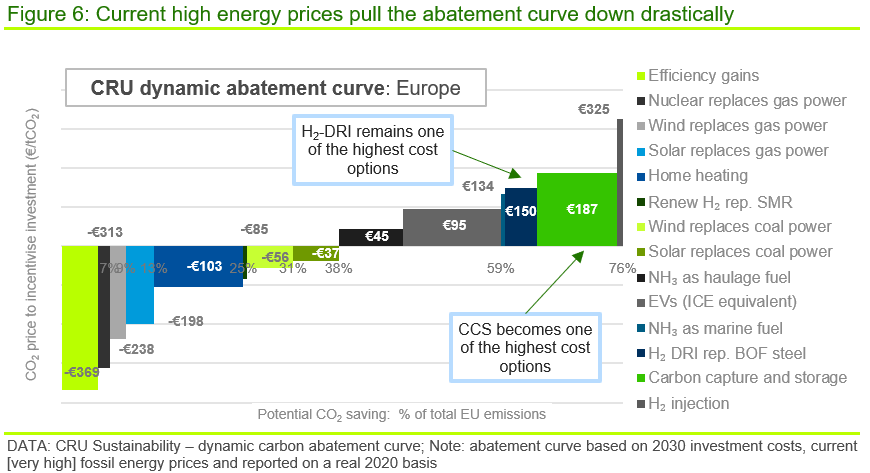

If we feed current high energy prices into this curve, we can see that it drops significantly as higher energy prices do some of the work of a carbon price.

That is, today, many of the technology shifts to low carbon can occur at negative carbon prices as high energy prices are doing all the work, and more, to render low carbon alternatives economically viable. Given the carbon price in Europe is currently ~€90 /tCO2, this suggests 40–60% of emissions could be economically abated. Again, this is not because renewable energy is ‘cheap’, rather because fossil energy is now expensive.

Interestingly, this adapted curve shows that carbon capture and storage (CCS) becomes one of the most expensive options as the business case for CCS does not benefit from high energy prices (i.e. CCS is an added cost on top of underlying energy costs, whereas renewables, for example, are a replacement for fossil fuels). It also shows that, even under current high energy prices, steel remains one of the more expensive sectors to abate.

If you are interested in discussing the interplay between energy prices, carbon prices and technology development or the conditions needed to incentivise decarbonisation across an economy, please get in touch. We would be happy to talk through our ideas.

Find out more about our Sustainability Services.

Our reputation as an independent and impartial authority means you can rely on our data and insights to answer your big sustainability questions.

Tell me more