Carbon capture and storage (CCS) costs are typically mis-quoted, failing to include full costs. In many cases, only ‘other’ operating costs are quoted, but these account for only ~10–15% of total costs from capture to injection. Full costs of CCS must cover the initial investment, financing, energy use (n.b. which leads to a significant loss of output at the power plant that is typically ignored), ‘other’ operating costs and distribution as well as injection costs.

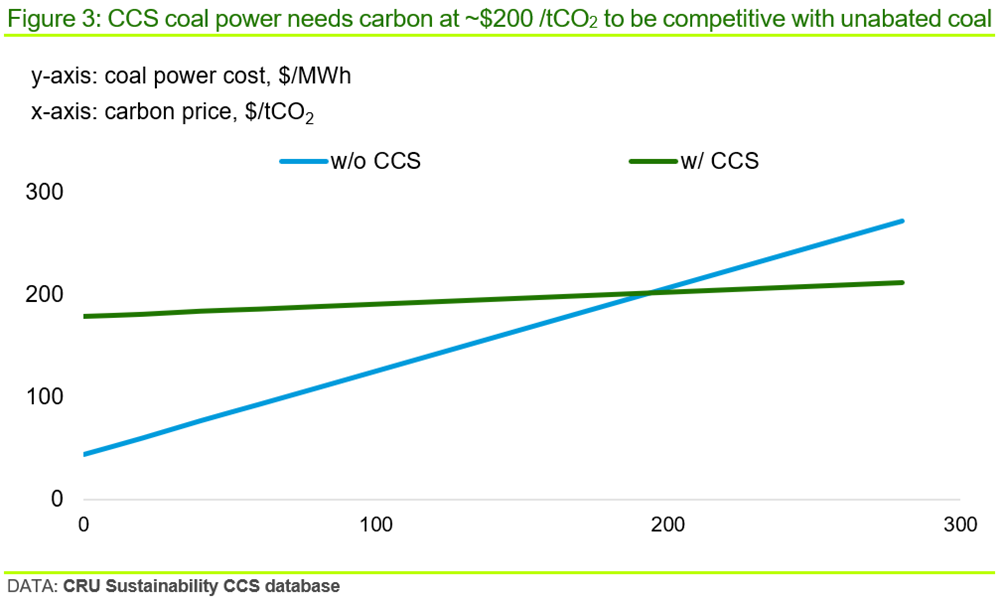

CRU’s CCS database covers historical and proposed projects — including capacity, end-use, technology and costs — and shows a carbon price of ~$200 /tCO2 is needed for currently proposed CCS coal power projects to be competitive. Thus, neither the current carbon price in Europe (i.e. ~$100 /tCO2) nor the 45Q tax credits for CCS under the US IRA (i.e. $85 /tCO2) are sufficient to incentivise investment in CCS without other support. This conclusion has implications not just for coal power, but for all hard-to-abate sectors for which CCS is considered a decarbonisation solution.

CRU provides credible and independent views of costs and technology development, vital for the energy transition. This Insight is one of many highlighting this work.

Coal power is the highest cost application of CCS

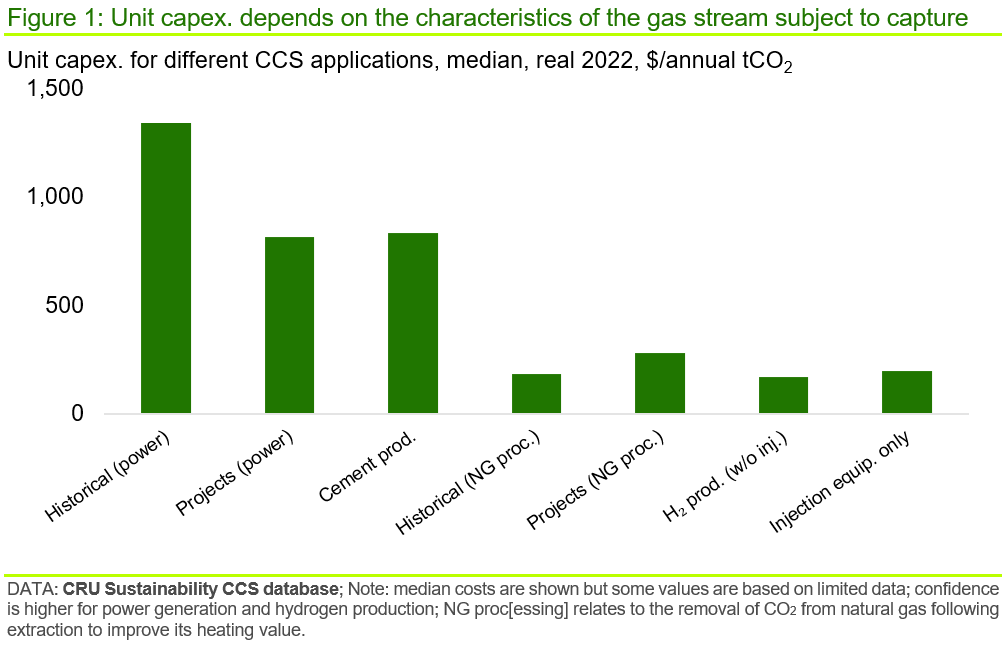

CRU has built a database of over 300 carbon capture and storage (CCS) projects globally dating from 1972 to present day, as well as proposed future developments. These projects cover different CCS applications including power generation, natural gas processing, hydrogen production (i.e. blue hydrogen), cement production and others. For many of these projects we have been able to collect capex. and capture data. The chart below presents a high level view of capex. costs for CCS in different end-uses.

The chart shows that the unit capex. of a carbon capture facility can vary significantly, which is largely driven by different characteristics of the off-gas or tail gas from which the CO2 is captured. Off-gases with high a CO2 concentration and/or high partial pressure typically require a less costly CCS process than off-gases with low CO2 concentration and low partial pressure. For example, power plants with a low pressure off-gas stream that contains 10–15% CO2 will have a higher unit capex. cost than a steam reforming hydrogen production unit that has an off-gas with both higher CO2 concentration and pressure. These different conditions will dictate the size and complexity — and therefore investment cost — of the installed equipment.

Further, the data for power generation suggests that costs of CCS installations have fallen. Proposed projects exhibit a median unit capex. of ~$800 /annual tCO2 collected (real 2022), whereas historical projects are >$1,300 /annual tCO2 (real 2022). However, this cost reduction probably does not reflect the true cost reduction seen over time, which is expected to be smaller than suggested, as the sample of historical installations includes a high proportion of smaller-scale demonstration projects that, by default, will be higher cost than full scale commercial operations. The sample of future projects includes a majority of commercial-scale operations and we believe the median value given is more representative of a large-scale plant in the near-to-medium term.

Carbon capture requires significant sacrifice in power plant output

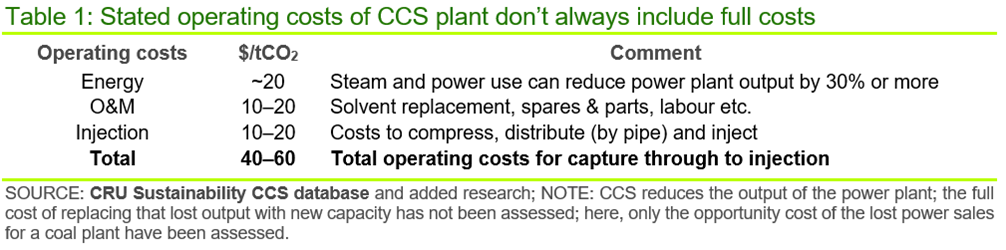

Quoted operating costs of a CCS plant, where these are available, can vary widely but we believe this is less due to specific differences in operating costs themselves and more due to the boundary conditions within which quoted operating costs are measured.

For example, a CCS plant associated with a power station will consume significant quantities of steam and power that are usually taken directly from the power station steam and power circuits. However, necessarily, this means the saleable output of power is reduced significantly. Thus, depending on whether the stated operating costs include the opportunity cost of lost power sales, or uplift in cost associated with the lower output, will affect the value given. Also, stated costs may or may not — and often do not — include the cost of distributing and injecting the captured CO2.

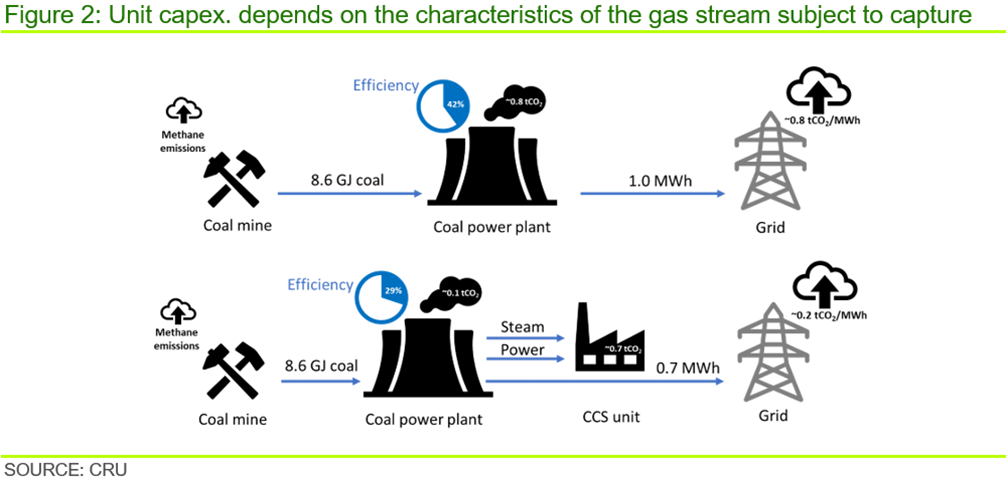

A typical MEA (i.e. monoethanolamine)-based CCS facility consumes ~2.5 GJ/tCO2 of steam to strip the collected CO2 from the solvent, and between 90–125 kWh/tCO2 of power for compression, pumping liquid solvent, cooling and other duties. Thus, for a coal-fired power plant operating at 42% efficiency, a CCS unit capturing 80–90% of carbon emissions will reduce net output of the plant by ~30%. At typical, historical wholesale power prices, this use of internal energy would amount to ~$20 /tCO2 of lost sales or more (i.e. a loss of 0.3 MWh at $50 /MWh wholesale price to collect 0.7 tCO2; see Figure 2). For a lower efficiency plant — that is, emitting more CO2 per unit of output — the loss of output might lift towards 35%, as more energy is consumed.

The equivalent value for a gas-fired power plant operating at 55% efficiency would be a reduction of ~15–20% of output depending on the capture rate.

Increasingly, it is suggested that CCS facilities can capture up to 99% of the CO2 in a gas stream. While this is probably correct in theory — if unproven under full-scale commercial operation — there will be an energy penalty for doing so that is typically ignored. In practice, most operating CCS plants have captured up to 85% of the CO2 in the gas stream, which is likely an economic compromise between cost and capture rate, and this is used as a base case here. The assumption of a higher capture rate introduces significant risk that, in practice, emissions reductions will not be as high as some expect. Further, CCS at a coal-fired power plant will do nothing to abate the methane fugitive emissions at coal mines.

Other operating costs associated with the solvent make-up, labour, spares & parts as well as sustaining capital amount to ~$10–20 /tCO2. Distribution and injection costs will add a further ~$10–20 /tCO2, although this will depend very much on the proximity of the storage deposit. Thus, full operating costs of a CCS facility on a coal-fired power station could vary between ~$40–60 /tCO2 at typical, historical wholesale power prices.

Where we could find information, quoted operating costs for CCS facilities associated with fossil-based hydrogen production (i.e. steam methane and/or autothermal reforming; SMR and ATR) are of the order ~$20–35 /tCO2, which specifically does not include distribution and injection costs. This would put total costs of CO2 capture, distribution and injection at ~$30–45 /tCO2. This fits with the expectation that operating costs for CCS on SMR/ATR units are lower overall than on a power station due to higher tail gas CO2 concentrations and pressures.

CCS needs CO2 at ~$200 /t to compete with unabated coal

Using proposed project costs and assumptions such as a 7% WACC, 25% tax, 30-year project lifespan and 12% working capital requirement, the CCS plant's Levelised Cost of Captured CO2 (LCOCC) would be ~$131 /tCO2.

From the perspective of power costs, not just capture costs, a CCS plant capturing 85% of emissions from a coal-fired plant would lift the Levelised Cost of Electricity (LCOE) from an unabated ~$125 /MWh to ~$190 /MWh based on the following assumptions:

- typical coal plant asset base and non-fuel operating costs

- a coal price of $3.6 /GJ (i.e. pre-energy crisis, steady-state coal price)

- an efficiency of 42%

- unabated carbon emissions of ~0.82 tCO2/MWh

- current carbon price of ~$100 /tCO2

But, while CCS is not competitive today, as carbon prices rise — where they are applied — coal-fired CCS will become increasingly competitive with unabated peers, but parity is only achieved at a carbon price of ~$200 /tCO2 under the assumptions described. That figure would be higher for coal plants operating at lower efficiencies, such as in the USA. For context, this required carbon price can be compared with that in Europe today of ~$100 /tCO2 (i.e. ~€90 /tCO2) and the 45Q carbon capture tax credit under US Inflation Reduction Act of $85 /tCO2. Neither is sufficient on their own to incentivise carbon capture on a coal-fired power plant. The equivalent breakeven CO2 price for a natural gas-fired power plant would be ~$180 /tCO2.

The use of captured CO2 for enhanced oil recovery (EOR) could provide additional revenue to support the building of CCS plants. However, given each tonne of CO2 used for EOR ultimately leads to an additional CO2 emission of ~0.7–2.9 tCO2 from the added oil produced, it seems unlikely this approach could form part of a sustainable future.

Of course, all of the above assumes that suitable geological deposits can be found for storage of the captured CO2 and that these are in relatively close proximity to the power station. The proximity of geological deposits could have a significant influence on the costs shown and, therefore, on the carbon price needed to incentivise the installation of CCS.

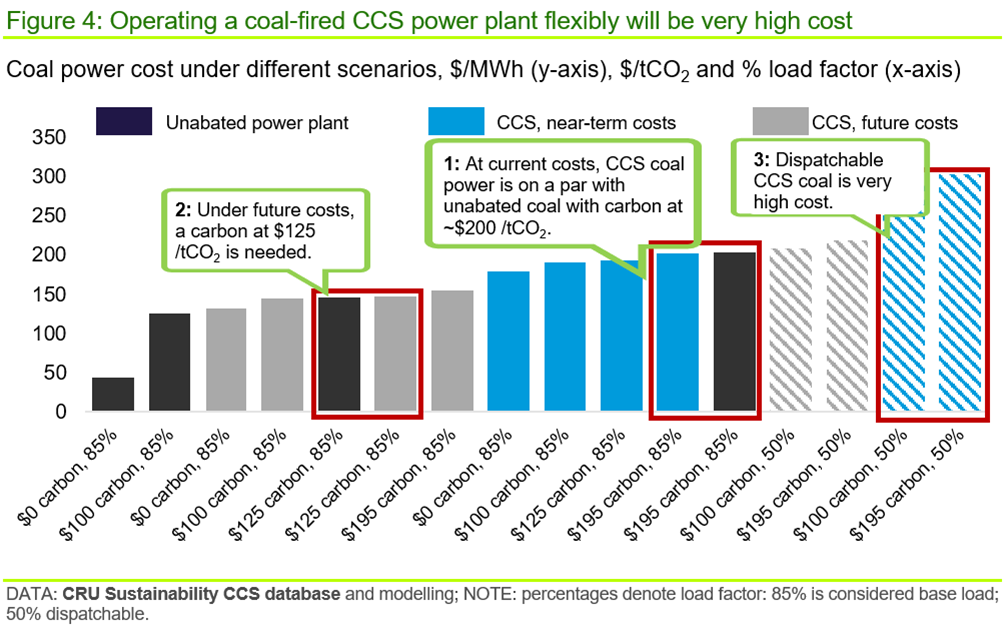

CCS costs can fall but dispatchable power costs will stay high

It is generally assumed that CCS costs will fall, leading to lower LCOEs of coal-fired power with CCS, but this can only happen if commercial scale facilities are installed in the near term, at current high costs, such that the technology can move up the experience curve. The current cost disadvantage makes this difficult to achieve without support. That aside, assuming a 30% reduction in unit capex. (n.b. which has been suggested by some equipment providers), lower energy use and, therefore, only a 25% loss of power plant output as well as a reduction in other operating costs to $20 /tCO2, all by 2050, gives an LCOE of ~$145 /tCO2. This would lower the carbon price needed to put CCS-derived coal power on a par with unabated technology at ~$125 /tCO2. However, this isn’t the full story.

Many commentators propose coal-fired CCS power would, by necessity, be dispatchable, providing intermittent power to balance shortfalls in output from variable renewables. This means that boiler, steam turbine and CCS equipment, as well as associated distribution and injection equipment, would have to be sized for the maximum output of the power plant, but would operate at low load factors for much of the time, when renewable output is high. Using CCS in this way brings several disadvantages:

- Firstly, CCS is a high capex. decarbonisation solution and low load factors will raise the unit annual capital charge substantially, lifting the LCOCC.

- Secondly, the thermal cycling associated with stops and starts will lead to lower capture and energy efficiencies as well as equipment availability issues.

- Thirdly, a frequent start/stop regime would require added investment on equipment, added maintenance and would lower efficiencies at both the coal and CCS plant.

Our modelling suggests that the LCOE of coal-fired power plant with CCS, operating at an average load factor of 50%, would rise to ~$290 /MWh at steady-state fuel costs and a carbon price of $100 /tCO2. We believe this is a conservative estimate of costs under dispatchable conditions.

The costs of the various configurations modelled and discussed above are set out below.

This analysis suggests that base load, CCS-based coal power could be competitive with unabated coal power at carbon prices that are envisaged in the future (i.e. ~$200 /tCO2 falling to ~$125 /tCO2; see CRU’s Long Term Carbon price forecast), but investment is needed now to allow CCS technology to move up the experience curve and make this a reality.

Thus, CCS-based coal power could be an economically viable part of the power mix, but only if suitable storage sites can be found, public perceptions of CCS improve and residual emissions as well as structurally higher power prices are acceptable. However, given the capex. intensity of CCS and operational challenges of flexible operation, dispatchable CCS-based coal power to balance increasing renewables on the grid (n.b. which many suggest would be the major role for CCS-based power) is highly unlikely to be a viable solution in our view. This is even before considering the significant variability constraints on distribution and injection of CO2. Operation of such capital and energy intensive equipment at low load factors is unlikely to be a viable proposition and costs will rise rapidly.

If you want to know more about our analysis of carbon capture or want to get a more transparent, realistic and independent view of costs under the energy transition and decarbonisation, get in touch and we’d be happy to talk about our work.

Find out more about our Sustainability Services.

Our reputation as an independent and impartial authority means you can rely on our data and insights to answer your big sustainability questions.

Tell me more